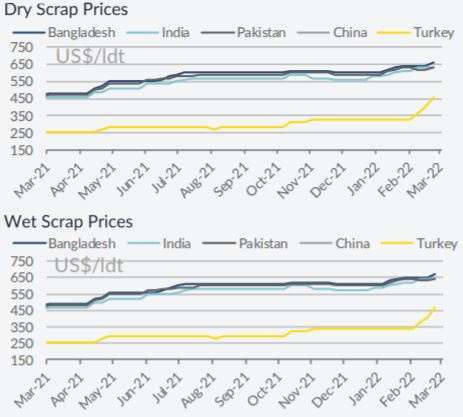

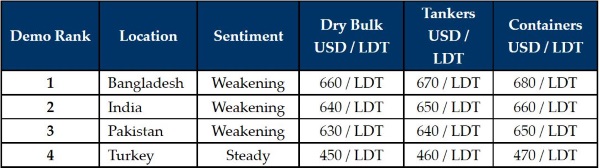

The ship recycling market has entered a correction phase, after several weeks of price increases. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “this week saw price levels tumble southwards on the back of falls in global steel/commodity markets against the speculation that a peace agreement is near fruition between Russia and Ukraine which would allow a resumption of increased steel exports. In particular, the domestic steel markets in Bangladesh and India witnessed a sharp correction at the beginning of the week with reports India fell by some USD 60-70/ldt and Bangladesh by some USD 30-40/ldt for ship recycling. Having seen a continued rise in rates over several weeks, the recycling market has certainly mirrored global steel markets with these significant drops, however the latter part of the week did find finally see a sense of stability return and talk of levels rebounding. However, even if a peace agreement was reached, and let us pray that it will be soon, it is likely to be months before any lifting of sanctions will be discussed and steel exports allowed to resume”, the shipbroker said.

Source: Clarkson Platou (Hellas) ltd

In a separate note, Allied Shipbroking added that “the ship recycling market did not impress as of the past week, in terms of activity, given the limited number of units being concluded for demolition. In the Indian Sub-Continent, despite the fact that the offered scrap price levels are still holding firm at levels of around mid/high US$ 600/LDT and even managed to gain a bit of ground this week, there is a slight feel that we may have reached a temporary ceiling to some extent and some slight correction in the short term may well be felt. More specifically, in Bangladesh, the market indicated an upward resistance, given the step back noted in local steel plates.

Source: Allied Shipbroking

At the same time, the Pakistani market remained rather sluggish, despite its recent firm presence and buying appetite. In India, the market started the week on a bearish tone, given both the decline in local steel plate prices and local currency, but it rebounded fairly quickly. Finally, in Turkey, things are also seemingly in a state of transition after the fairly sharp rise in offered price levels noted over the past few weeks, being pressured to some degree by the small declines seen in local steel price levels”, Allied concluded.

Meanwhile, GMS, the world’s leading cash buyer of ships said that “there is talk this week that markets may well have peaked as Bangladesh, India and even Turkey suffered some falls from some of the record steel plate prices seen recently. Cooking oil and commodity prices are chiefly to blame for this dip, but it also cannot be expected that the markets will continually go up (as they have been doing for nearly the last two years). The unfolding crisis in Ukraine certainly has affected global oil and gas prices and those countries that regularly purchase their reserves from Russia (such as India) are now having to hammer out new plans to sustain their local economies, especially given the bevy of sanctions currently in place. Yet, these are decade long highs that we are witnessing at present, and not since the heady days of 2008 have vessel prices been so firm. As a result, most owners are witnessing values on their end-of-life ships at least double over the past year or so”.

Source: GMS,Inc

GMS added that “notwithstanding, chartering markets, particularly in the dry and container sectors, continue to perform admirably and certain routes on tankers have once again started to pick up, which is increasingly depriving hungry Recyclers of tonnage and is keeping prices (artificially?) firm. Furthermore, despite this latest dip of about USD 20 – USD 30 / LDT, commodity prices remain firm and there certainly is scope for improvement once again, given that the end of the Ukraine crisis seems far from over at this juncture.

The Indian Rupee, despite firming marginally this week, has suffered some noteworthy currency reversals of late, compounding some of the drastic steel falls seen over the last 2 – 3 weeks. Finally, in the West End, steel fundamentals (both import and local steel plate) recorded depreciations of their own, with the Lira further aggravating the situation this week. Overall, it may perhaps take a week or two of stability before we understand where the new reality on prices actually is, as the coveted USD 700/LDT level (and above) still appears somewhat illusory for the most part and on most standard units”, GMS concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide.

Source: hellenicshippingnews.com

.png)